Unlocking the Benefits of a Tailored Debt Monitoring Plan Made by Professionals

In the world of economic administration, the intricacies surrounding financial debt can commonly existing difficulties that need a nuanced strategy. By handing over the layout and application of a tailored debt management plan to specialists in the field, individuals stand to open a pathway in the direction of monetary security and tranquility of mind.

Personalized Financial Debt Evaluation

An individualized debt assessment is a crucial first action in producing an efficient financial debt monitoring strategy tailored to a person's financial circumstance. This assessment entails an in-depth testimonial of the person's existing financial debts, earnings, expenditures, and financial goals. By evaluating these crucial factors, experts can acquire a comprehensive understanding of the person's monetary health and recognize areas that call for immediate attention.

During the customized financial obligation assessment process, monetary professionals function carefully with the private to gather needed information and documentation. This joint method makes sure that all appropriate information are considered, permitting an extra accurate analysis of the person's financial standing. Additionally, the personalized nature of this assessment makes it possible for experts to discover unique difficulties and possibilities specific to the person, leading the way for a customized financial debt monitoring plan that straightens with their requirements and objectives.

Ultimately, a tailored financial debt analysis acts as the foundation for establishing a targeted financial obligation administration strategy that addresses the individual's specific scenarios. By conducting a comprehensive assessment initially, specialists can develop a plan that offers practical options and workable actions to assist the individual gain back financial security.

Decreased Rate Of Interest

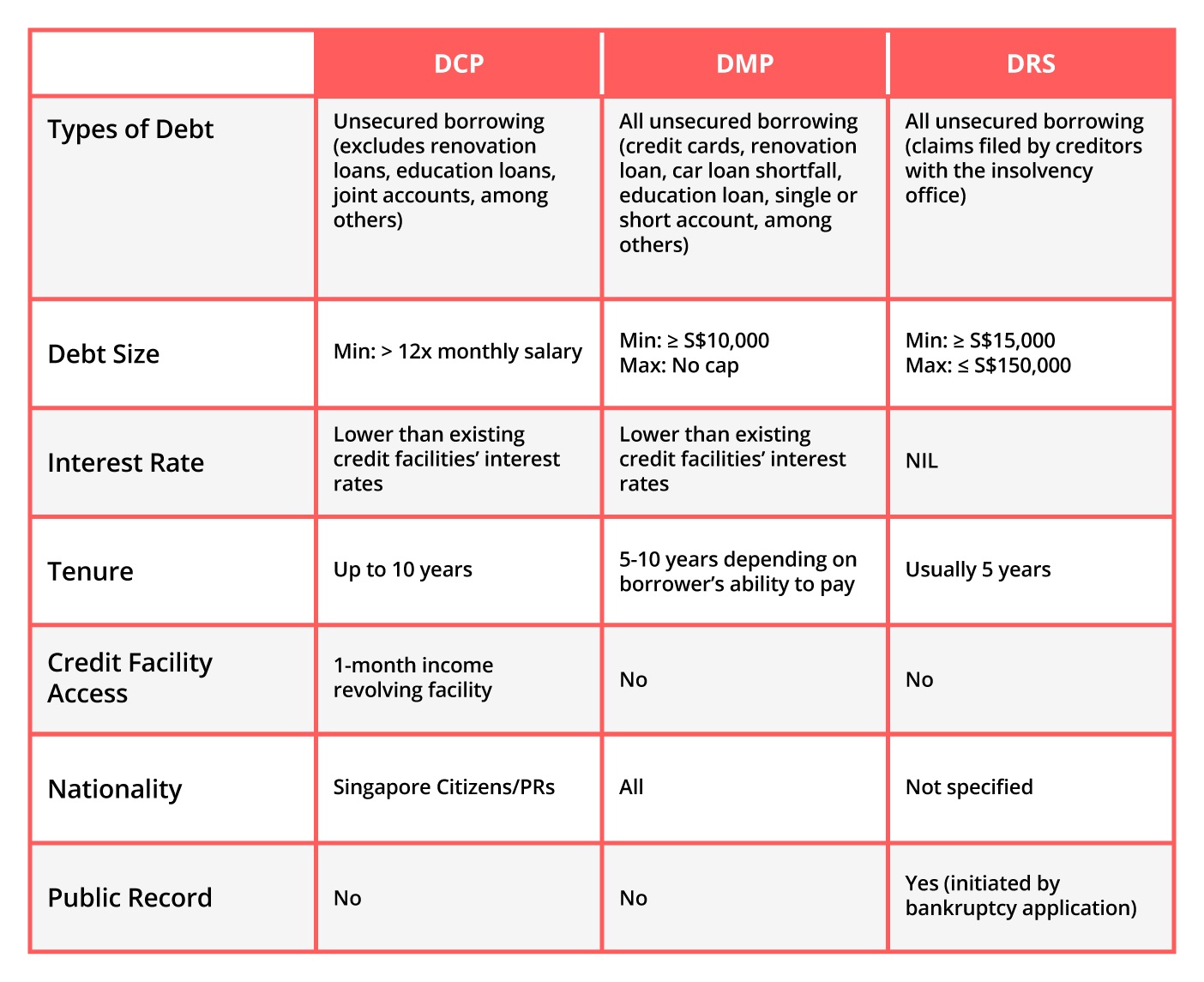

Adhering to a comprehensive tailored financial debt evaluation, one effective approach to reduce financial worry is to explore alternatives for lowered rate of interest on existing debts. Reducing rate of interest can dramatically lower the overall price of financial obligation settlement, making it more manageable for individuals dealing with financial debt. There are numerous methods to potentially protect decreased rate of interest, such as bargaining with lenders directly, settling financial debts right into a lower-interest loan, or enrolling in a debt management program that may help discuss minimized rates in support of the debtor.

Financial debt debt consolidation entails combining numerous debts into a single finance with a lower passion rate, simplifying repayment and possibly minimizing overall interest expenses. In addition, registering in a debt administration program can supply access to specialist mediators who have developed relationships with creditors and may effectively protect decreased rate of interest rates to assist in financial obligation resolution.

Financial Institution Arrangement Techniques

Effective interaction with financial institutions is vital to successful arrangement approaches in debt monitoring. When involving in financial institution arrangement, it is crucial to approach the conversations with a clear plan and a desire to coordinate. Among the main approaches is to open up a line of interaction with creditors as quickly as financial difficulties develop. By being proactive and transparent concerning the scenario, it is feasible to develop a foundation of depend on, which can promote more desirable negotiation outcomes.

Additionally, it is essential to comprehend the financial institution's viewpoint and constraints (debt management plan services). By showing a commitment to settling the financial obligation while additionally highlighting any kind of extenuating conditions that brought about the financial challenges, it might be possible to bargain even more flexible terms. Furthermore, providing a well-thought-out debt payment plan that straightens with both the borrower's economic capability and the lender's rate of interests can increase the chance of reaching an equally valuable agreement

Structured Payment Strategies

Comprehending the why not check here relevance of establishing cooperative interaction with creditors, the application of organized settlement plans is a calculated approach in the red monitoring that allows for methodical and arranged settlement of monetary commitments. Structured repayment strategies involve working with financial institutions to develop a schedule for paying off financial debts in such a way that is possible for the borrower while still fulfilling the financial institution's requirements. These plans usually lay out the complete quantity owed, the month-to-month installation quantities, and the duration of the repayment duration.

Ongoing Financial Support

Just how can people make certain proceeded economic security and success past organized payment strategies? Continuous monetary support plays a critical duty in aiding people browse their economic trip post-debt administration. debt management plan services. Specialist economic experts can give useful insights and assistance to help people make educated decisions, manage their expenditures, and construct a solid economic foundation for the future

Via recurring monetary guidance, people can receive tailored recommendations tailored to their one-of-a-kind economic circumstance. This support may include sticking and producing to a month-to-month spending plan, setting attainable financial objectives, and developing techniques to expand investments and financial savings. In addition, monetary experts can offer referrals on boosting debt scores, managing financial obligation responsibly, and planning for significant life events such as saving or buying a home for retirement.

Verdict

To conclude, a tailored debt administration strategy created by experts uses a personalized evaluation of one's monetary scenario, decreased rates of interest, efficient financial institution negotiation strategies, structured payment strategies, and continuous monetary advice. Applying such a strategy can help individuals restore control of their financial resources, lower financial debt, and work towards a more stable financial future. It is vital to look for specialist aid to browse the intricacies of financial debt monitoring and attain lasting economic success.

An individualized financial debt analysis is a crucial initial action in developing a reliable financial debt monitoring strategy customized to an individual's economic situation.Complying with a comprehensive personalized financial debt analysis, one reliable method to ease monetary concern is to explore alternatives for decreased rate of interest rates official site on existing debts. Lowering passion prices can substantially decrease the overall cost of debt settlement, making it a lot more manageable for people battling with financial debt. There are a number of ways to potentially secure decreased passion prices, such as discussing with lenders straight, settling financial obligations into a lower-interest finance, or signing up in a financial obligation administration program that may aid bargain decreased prices on behalf of page the debtor.

In addition, enrolling in a financial debt administration program can provide accessibility to expert negotiators who have actually established partnerships with lenders and may efficiently secure reduced interest prices to help in financial debt resolution.